Standard Chartered, SBI Holdings To Invest $100 Mln in Web3 in UAE

SB Holdings x Standard Chartered

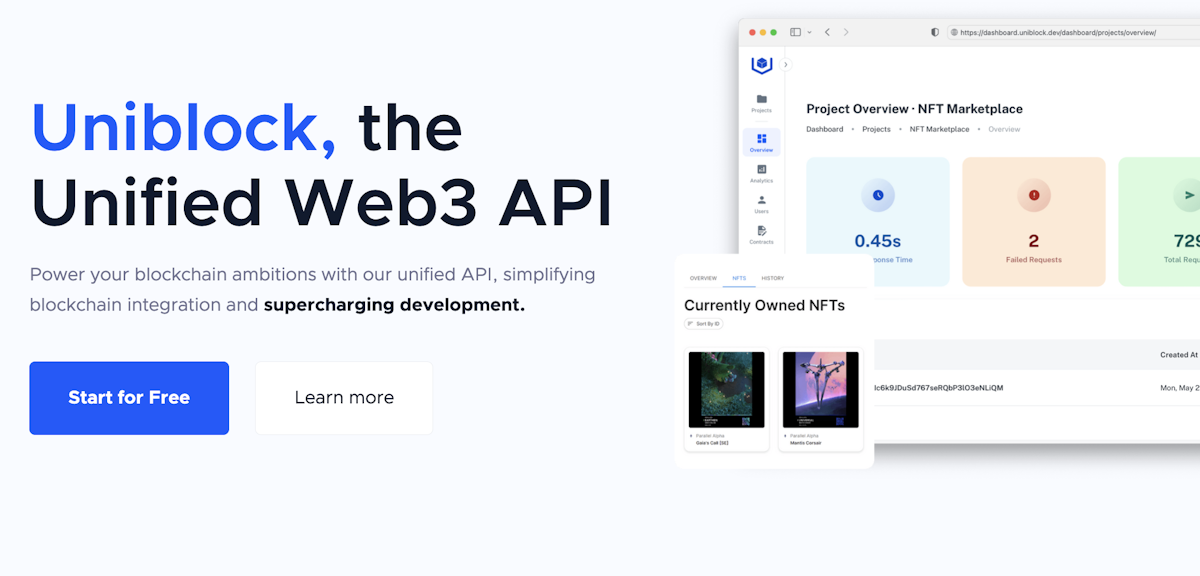

SC Ventures, the investment arm of Standard Chartered, and Japanese financial conglomerate SBI Holdings have partnered to create a cryptocurrency vehicle worth $100 million in the UAE.

The joint venture aims to invest in various crypto sectors, including decentralized finance, tokenization, infrastructure, payments, and the metaverse, covering seed to Series C funding rounds with a global investment focus.

The crypto market shows signs of a potential bullish sentiment, with Bitcoin currently trading at around $36,800, reflecting a year-to-date gain of over 120%.

Considering the market dynamics, SC Ventures and SBI Holdings are positioning themselves strategically in the crypto space. Notably, spot crypto trading volume on centralized exchanges increased in October after a four-month decline. This could indicate renewed interest in crypto, possibly in anticipation of the approval of a spot Bitcoin exchange-traded fund (ETF) early next year.

SC Ventures and SBI Holdings’ joint venture plans to make strategic and minority investments in crypto startups. They will utilize SC Ventures’ expertise in digital assets, including experiences with ventures such as Zodia Custody and Zodia Markets and previous investments in fintech firms like Ripple and Metaco. It’s worth noting that SC Ventures sold its stake in Metaco in May after Ripple acquired the company for $250 million.

CEO of SC Ventures Alex Manson said: “The Joint Venture will leverage SC Ventures’ experience in digital assets through our ventures, such as Zodia Custody and Zodia Markets, and our investments in fintechs like Ripple and Metaco.”

SBI Holdings plans to launch a fund by the end of the year to invest up to 100 billion yen ($663 million) in web3, AI, and fintech startups. The fund will have the support of several major Japanese financial institutions, including Sumitomo Mitsui Banking Corporation, Mizuho Bank, Nippon Life Insurance, and Daiwa Securities Group, who have pledged to invest over 50 billion yen in the fund.

Subscribe to UPYO News Newsletter to receive Latest, Breaking and Live Updates on Web3 Space.