Well-Known Egyptian actor Ahmed El Sakka became the first Egyptian and Arab actor who released his first NFT collection exclusively on UPYO, marking his first presence in the Web3 world.

The NFT collection will be released on the UPYO NFT marketplace, the largest of its kind in the Middle East, in cooperation with Arab Utopia Institution in a move to document Egyptian and Arab art with the latest technologies like metaverse and NFTs.

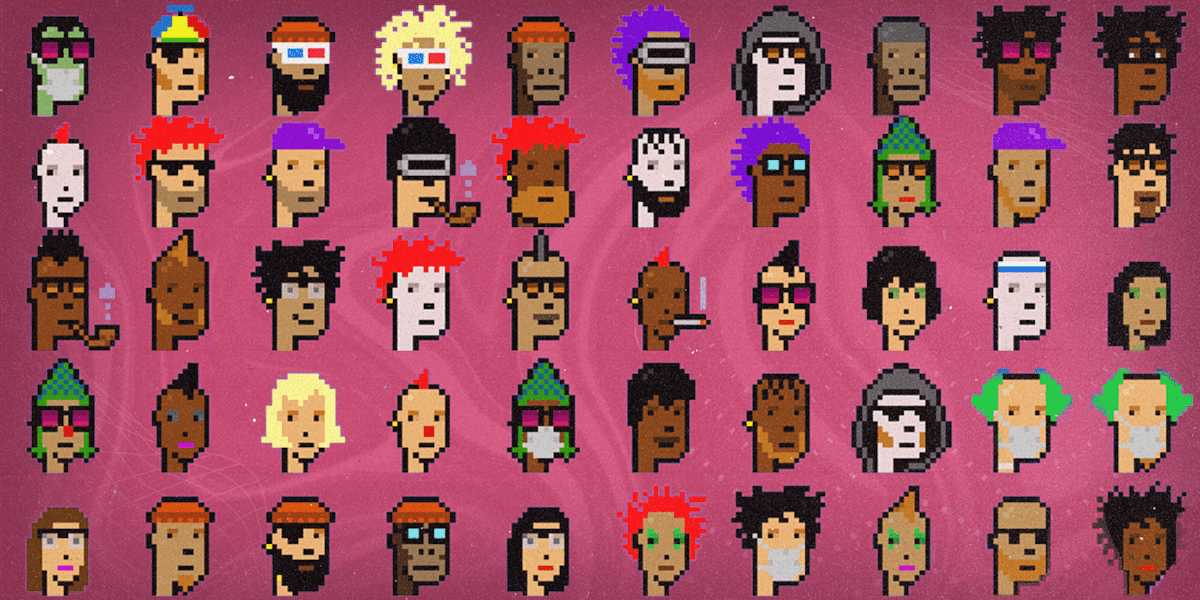

Named Al-Fares, the NFT collection consists of 5,555 digital collectibles, which are divided into four tiers (Bronze, Silver, Gold, and Diamond).

The NFT tickets work as a membership card for Sakka’s virtual world and grant access to exclusive features, which include, meeting Sakka virtually and in real life, experiencing interactive comics and games with the consumers’ avatars, and attending movie premieres.

Sakka’s first NFT collection comes within a framework of his keenness to document Egyptian and Arab art with the latest technologies like metaverse and NFTs.

Through this partnership, Sakka will attempt to document his art career through several activities in the virtual space, topped by releasing his first NFT collection, which was released on Tuesday.

The Egyptian actor will release more than five Arab action virtual games in which his cinematic characters will be shown, in addition to a virtual museum that will include his history in cinema and television, his personal belongings, and interviews in addition to belongings that appeared in his movies and series. His fans will be able to take part in his virtual games with their avatars to play with him in the metaverse.

In this regard, Sakka expressed his enthusiasm to join the Web3 world, looking forward that his fans would actively participate in the virtual games with him.

The move aims to document and turn Sakka’s long art history, which started in the 90s, into digital art. Through all these activities, El Gezira star will be the first Egyptian and Arab actor to join the metaverse and NFT worlds.

To mint an NFT or more of Al-Fares collection: https://upyo.com/en/nft/collection/al-fares/drop

Latest News

NFT

View allMetaverse

View allCrypto

View allBlockchain

View allWeb3

View allSubscribe to UPYO News Newsletter to receive Latest, Breaking and Live Updates on Web3 Space.